From the beginning,

we set out to address two questions:

1.) How would we like our own wealth to be managed?

2.) How would we like to be treated as investors?

Our response was to create a firm that offers a higher level of wealth management by providing institutional investment strategies based on decades of academic and empirical research while adhering to the highest standard of care and ethics in the investment industry. As it turns out, this makes us quite different.

Independent

We are an independent firm without any affiliations, shareholders, or biases. We work only for you, so our approach and advice are unconstrained.

FiduciarY / Fee Only

As a true fiduciary, we are held to the highest standards in the investment industry and will always put your interests first. We never accept commissions, so our choice of investments is always based solely on what’s best for you.

Transparency

Our evidence-based investment approach gives you greater transparency into our decision-making process. No matter what your level of financial literacy may be, we want you to clearly understand what we do and the costs to implement it.

Total Return Investing

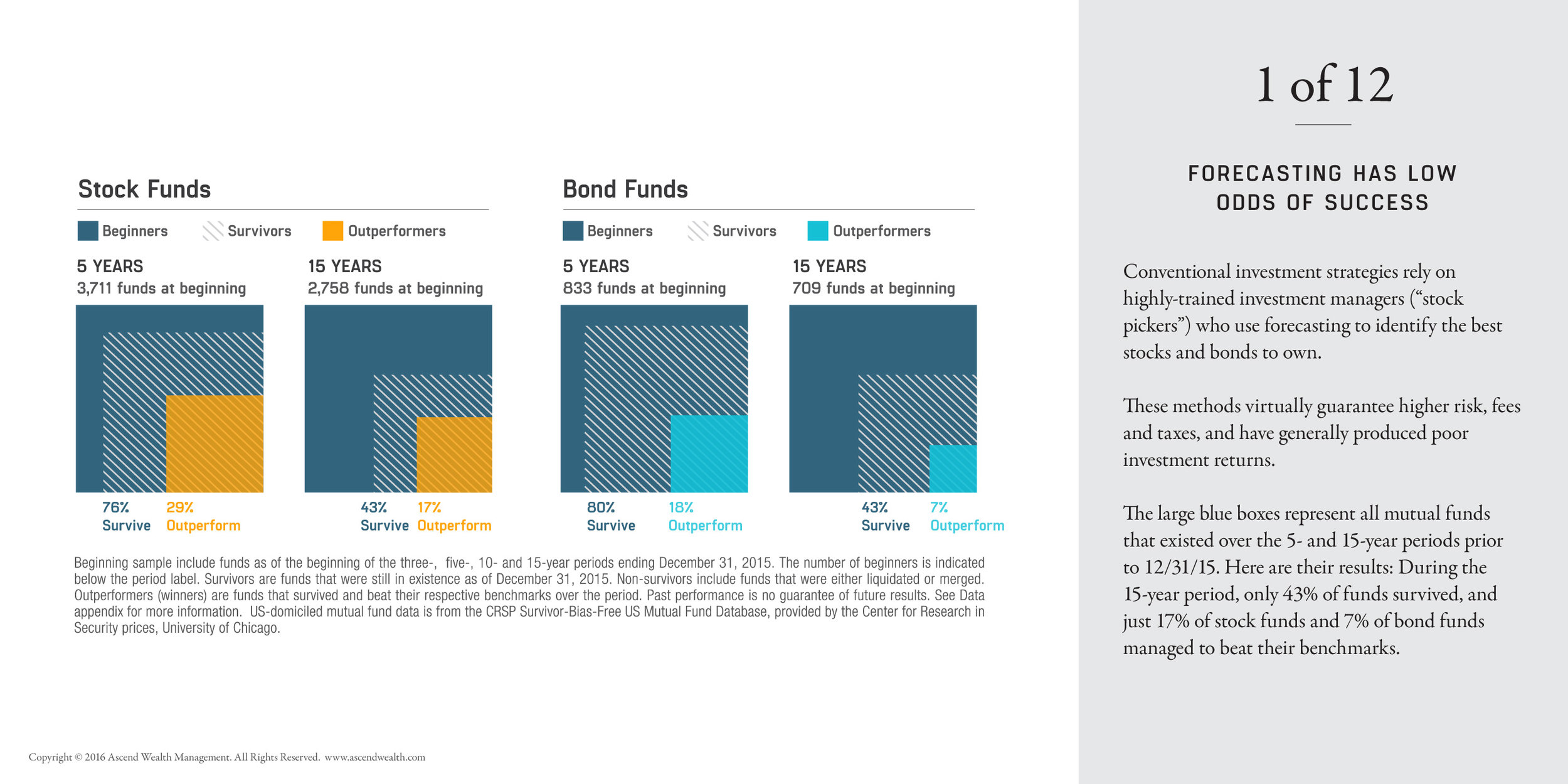

We only use no-load, low-fee funds to keep your costs down. We also utilize various advanced tax planning strategies and a special class of tax-managed funds in order to keep more of your money where it belongs—with you.

Alternatives

Investing in the private markets can be a savvy way to further diversify your investment portfolio. We have the experience to help you determine the suitability of these investments and how they might fit into your overall wealth strategy.

Risk Control

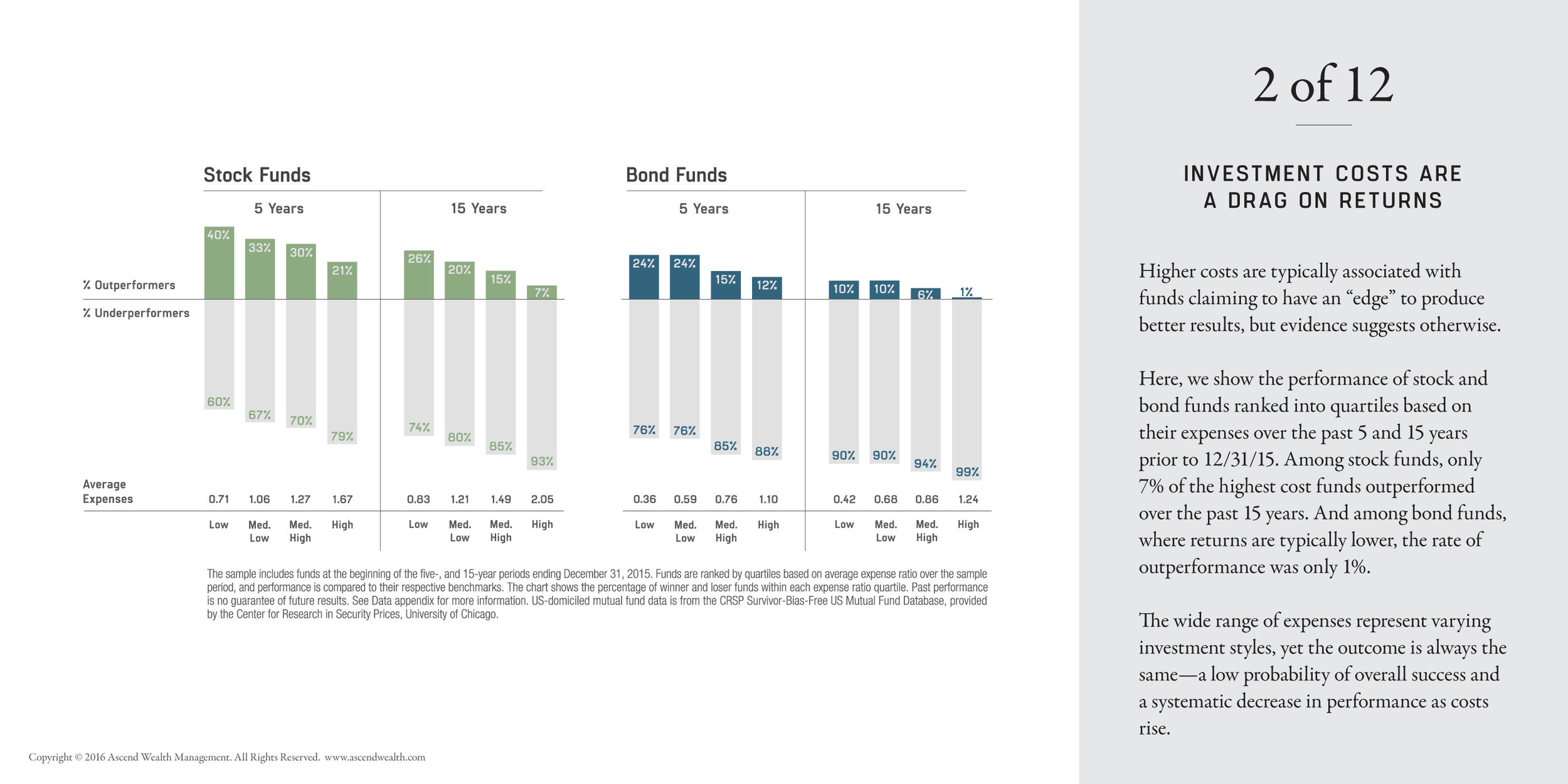

Investing can cause emotions of excitement and fear, both of which are counterproductive to achieving superior investment outcomes. We work with you to understand your risk tolerance and then customize an investment plan designed to produce better outcomes and peace of mind.

SUSTAINABLE INVESTING

If you are interested in adding environmental or social considerations to your portfolio, we can accommodate them with the appropriate recommendations. We provide access to a unique set of funds designed to meet these standards without compromising your financial returns.

Dimensional Funds

Proprietor Wealth Management is among a select group of wealth management firms approved to offer funds managed by DFA.

Informed by Evidence

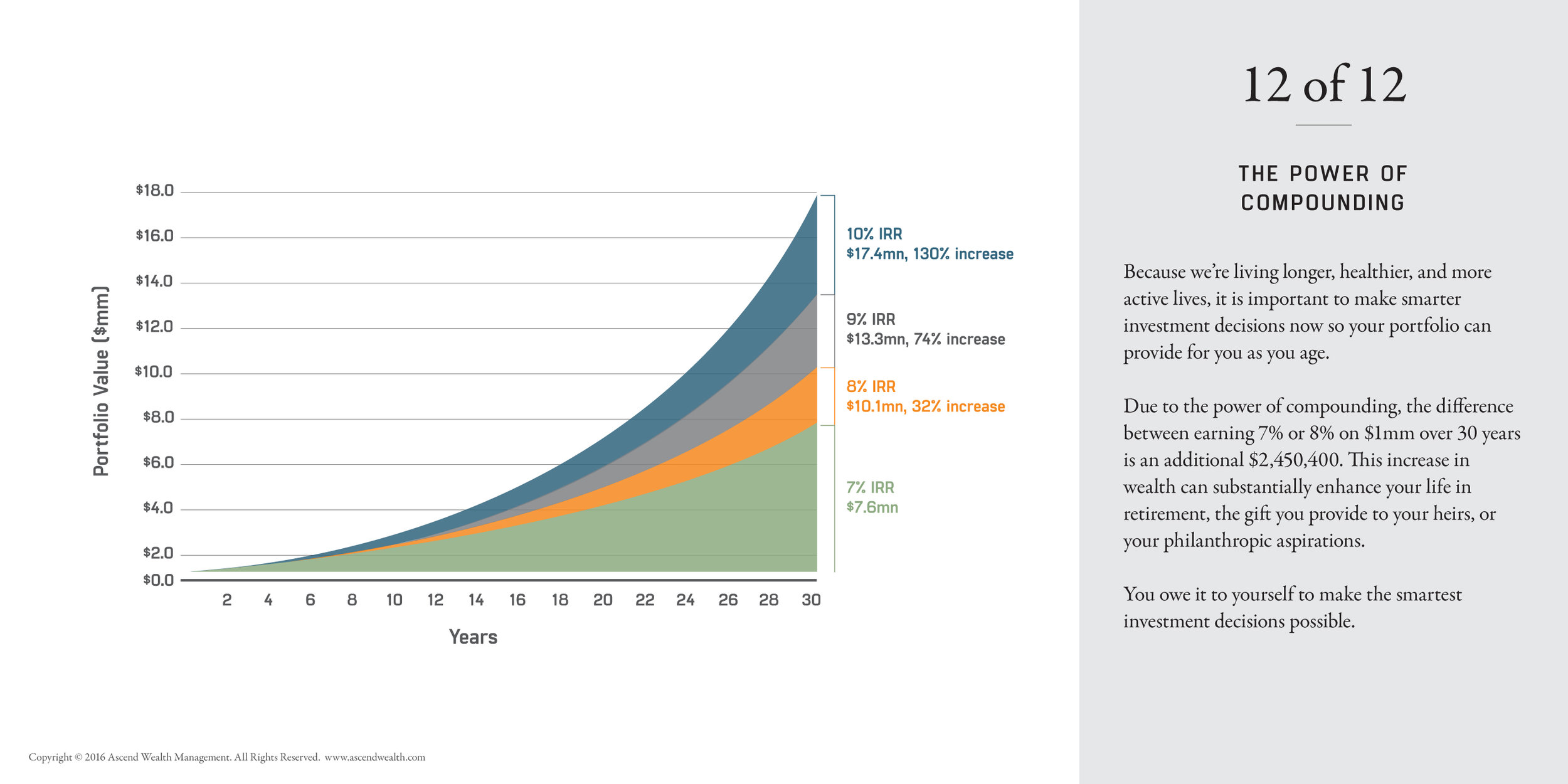

In order to achieve investment success, it makes sense to focus on the things you can control.

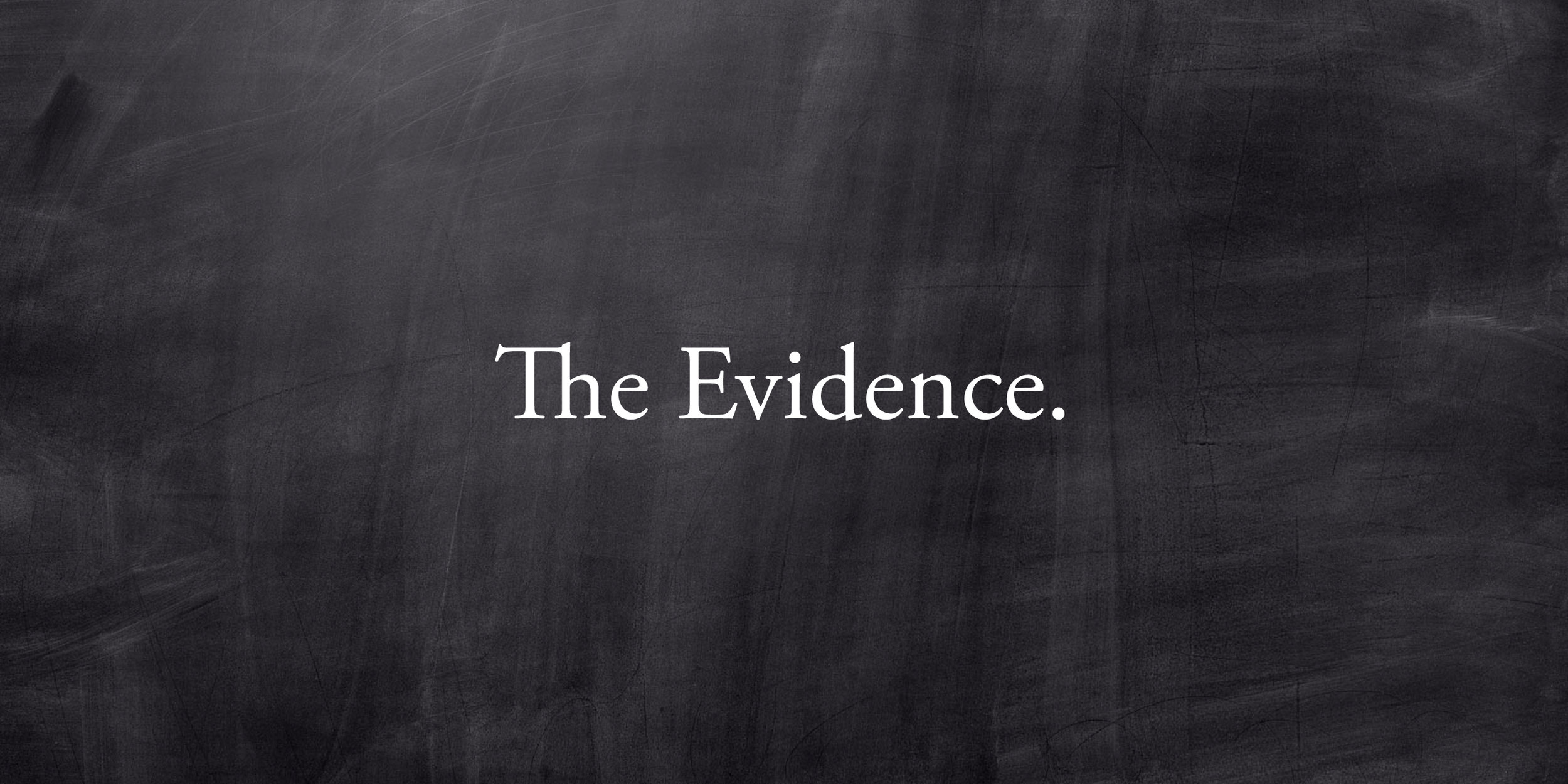

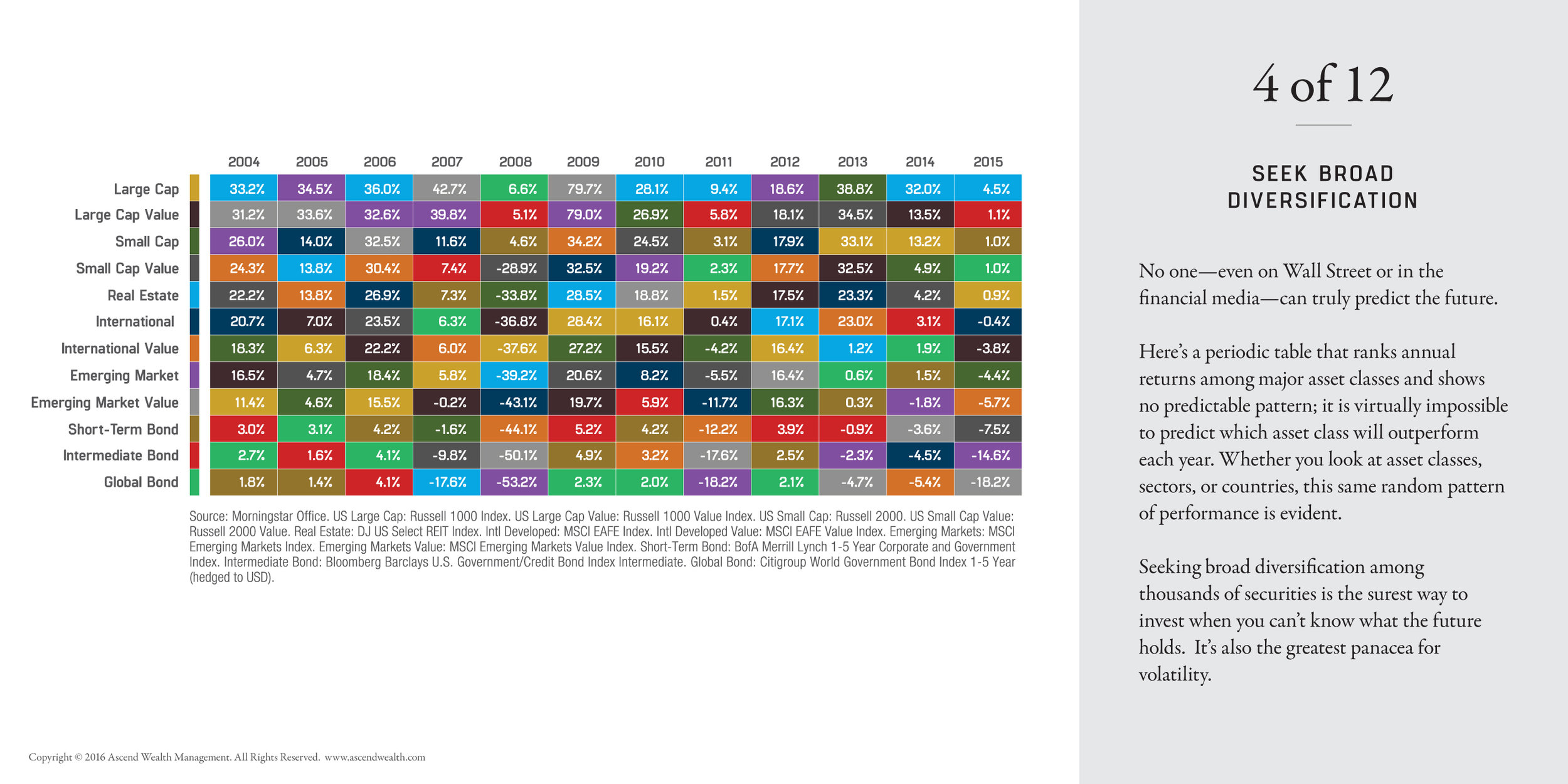

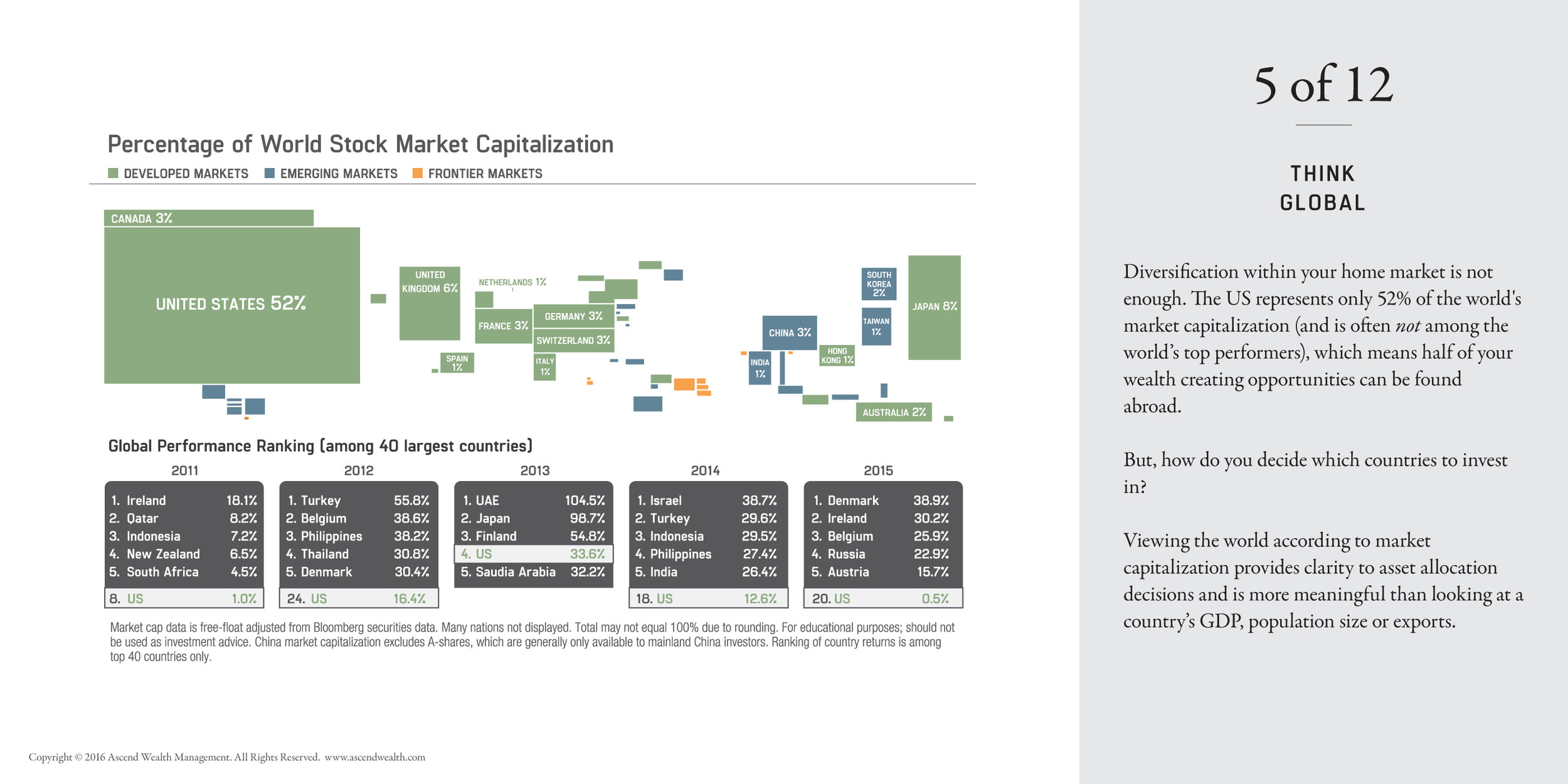

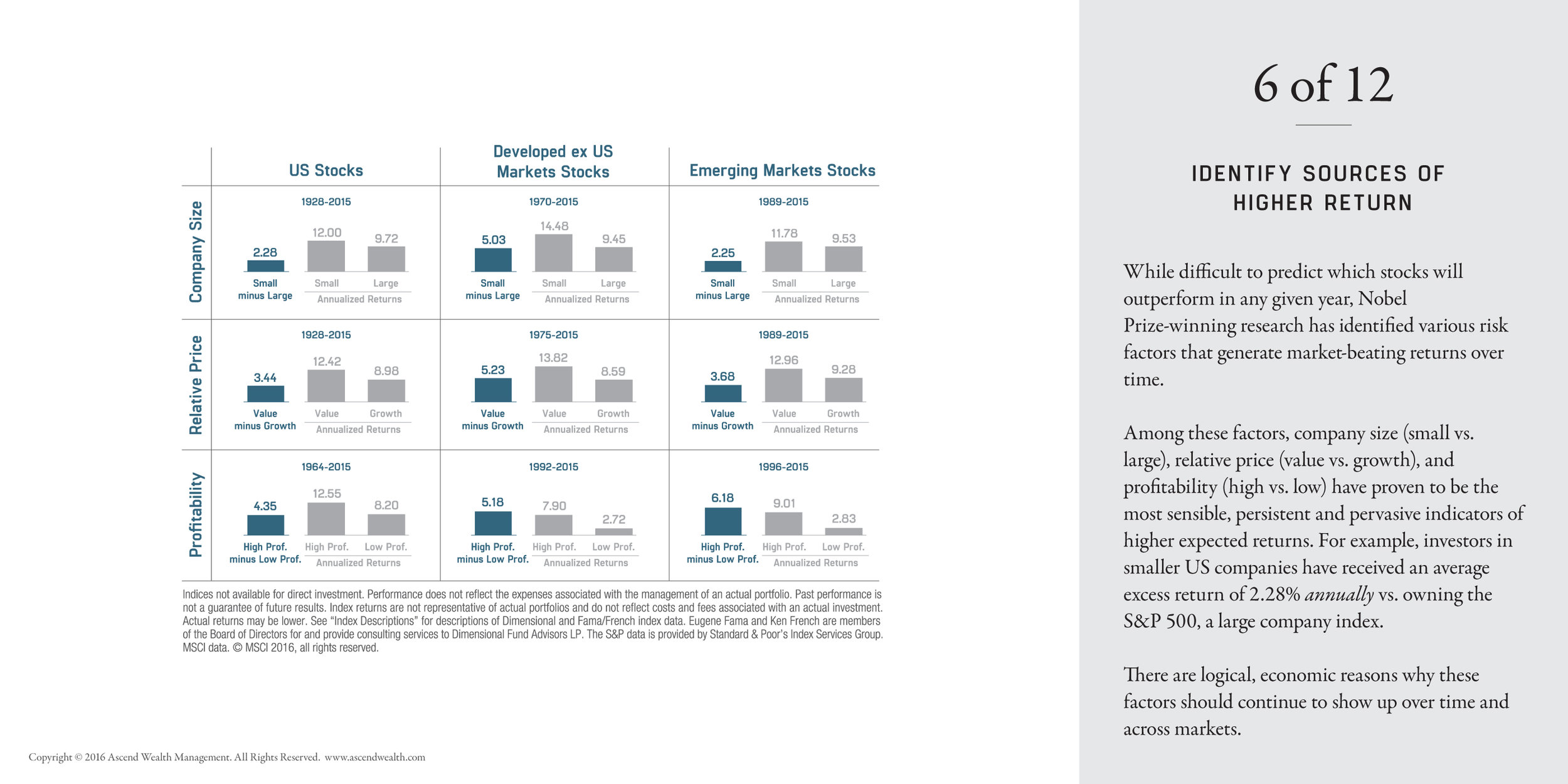

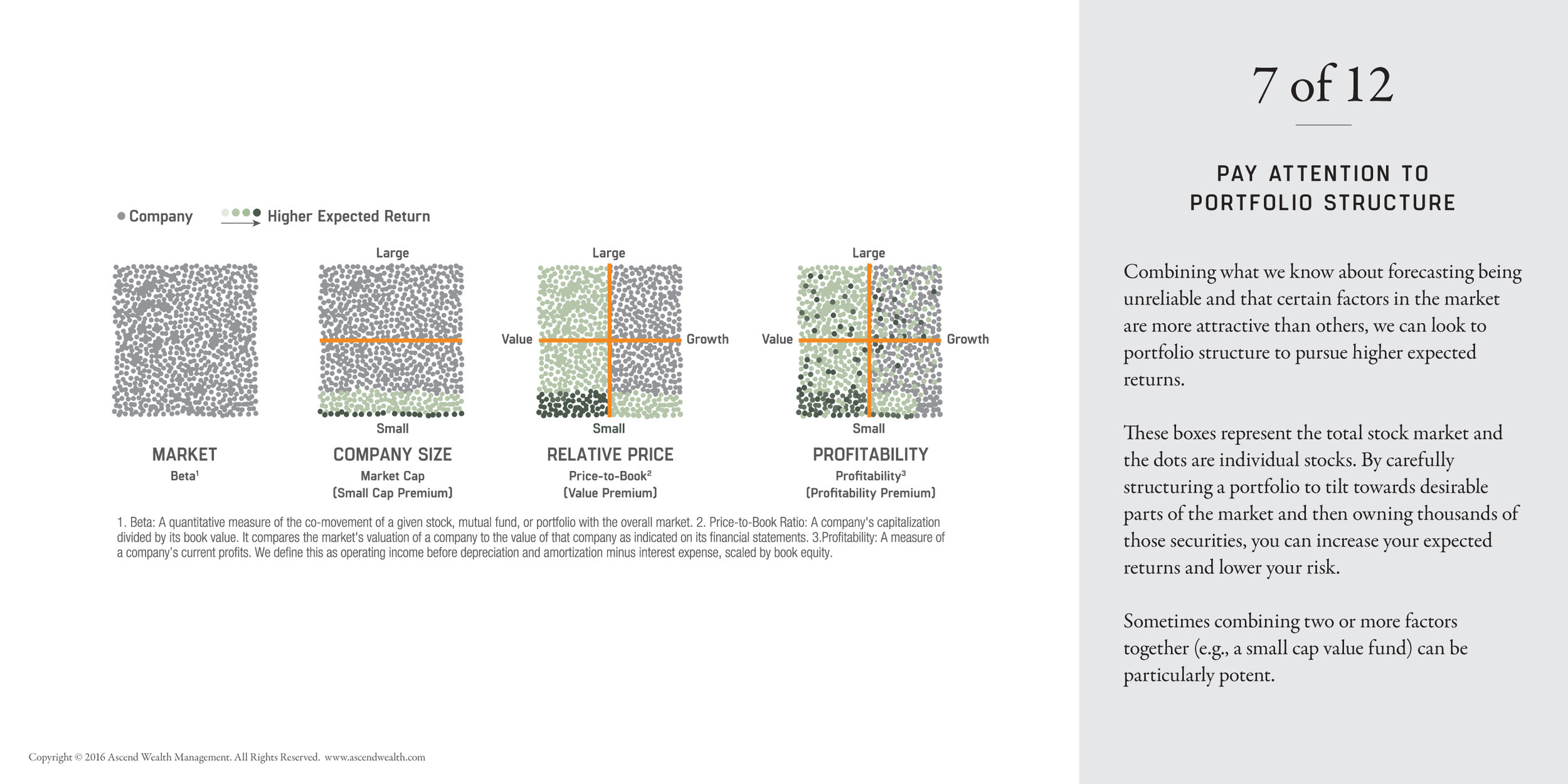

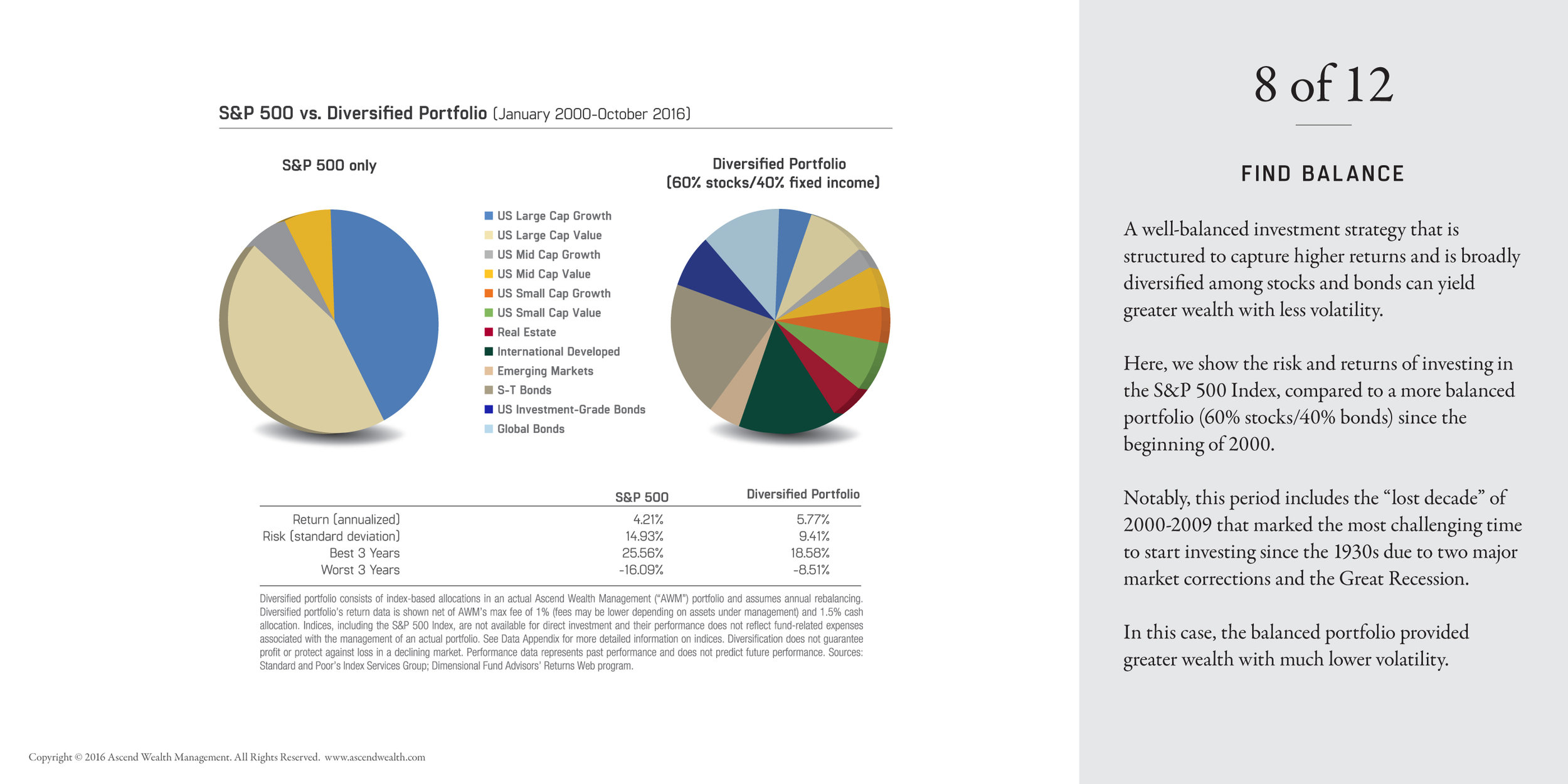

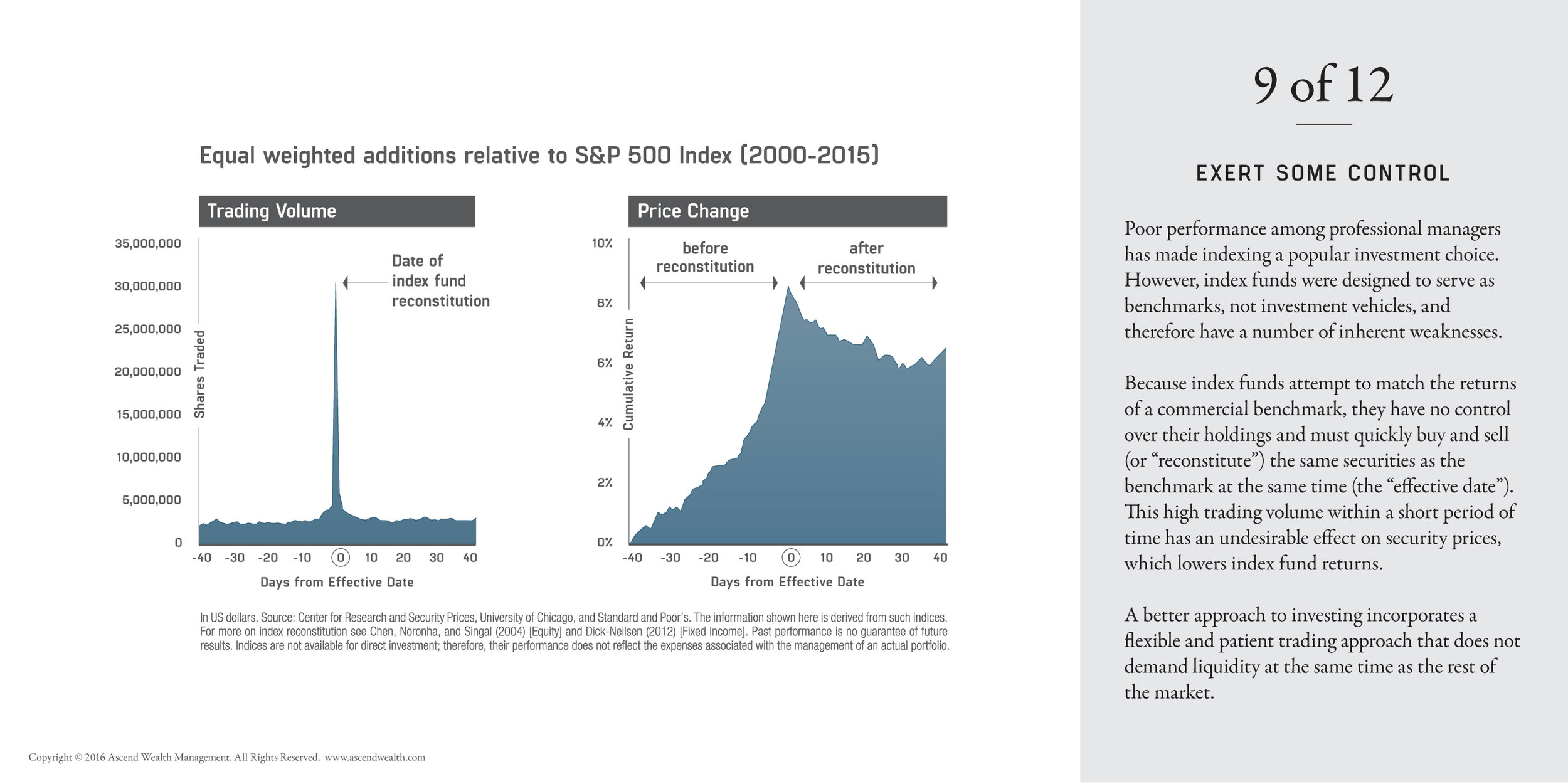

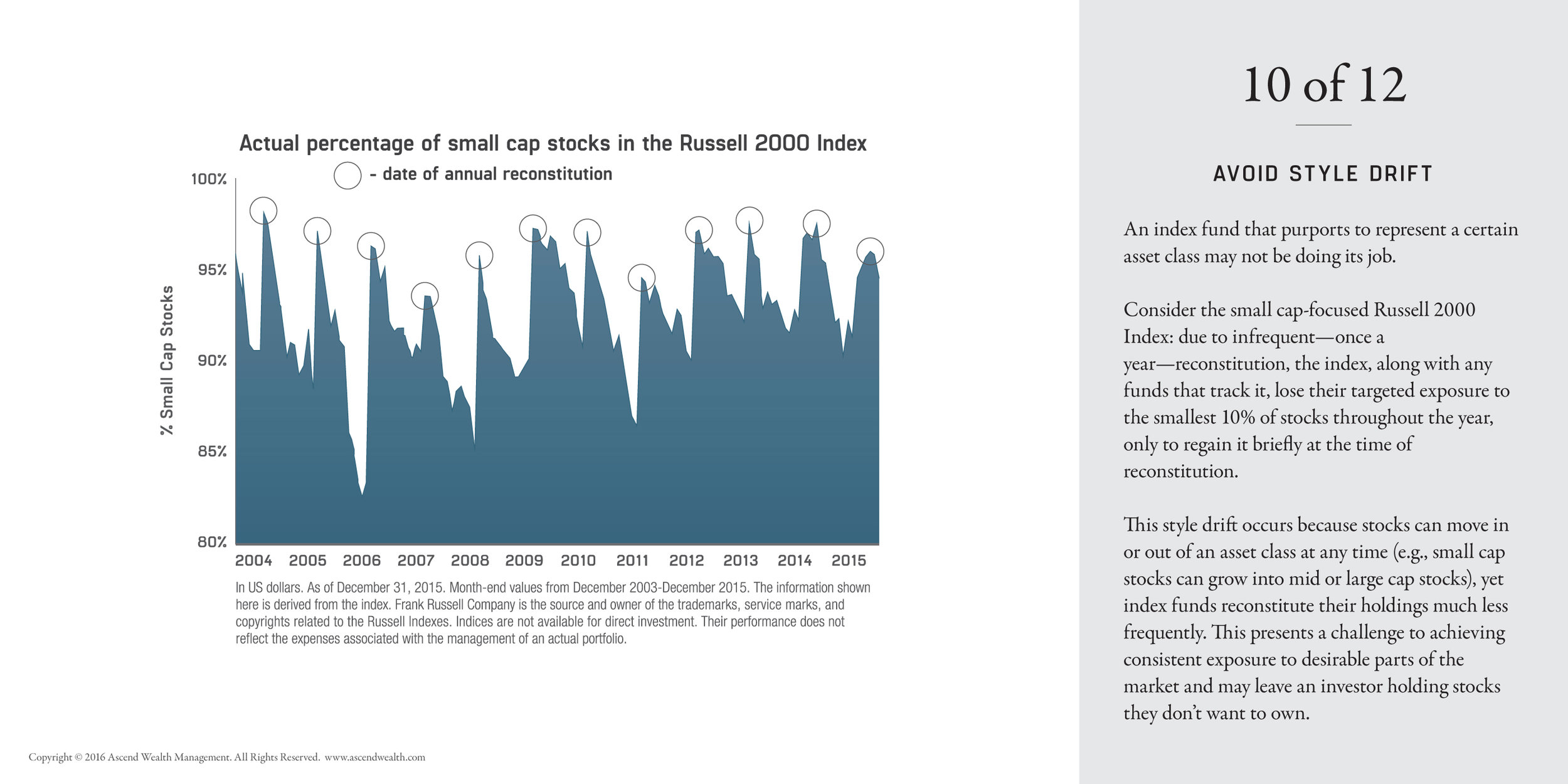

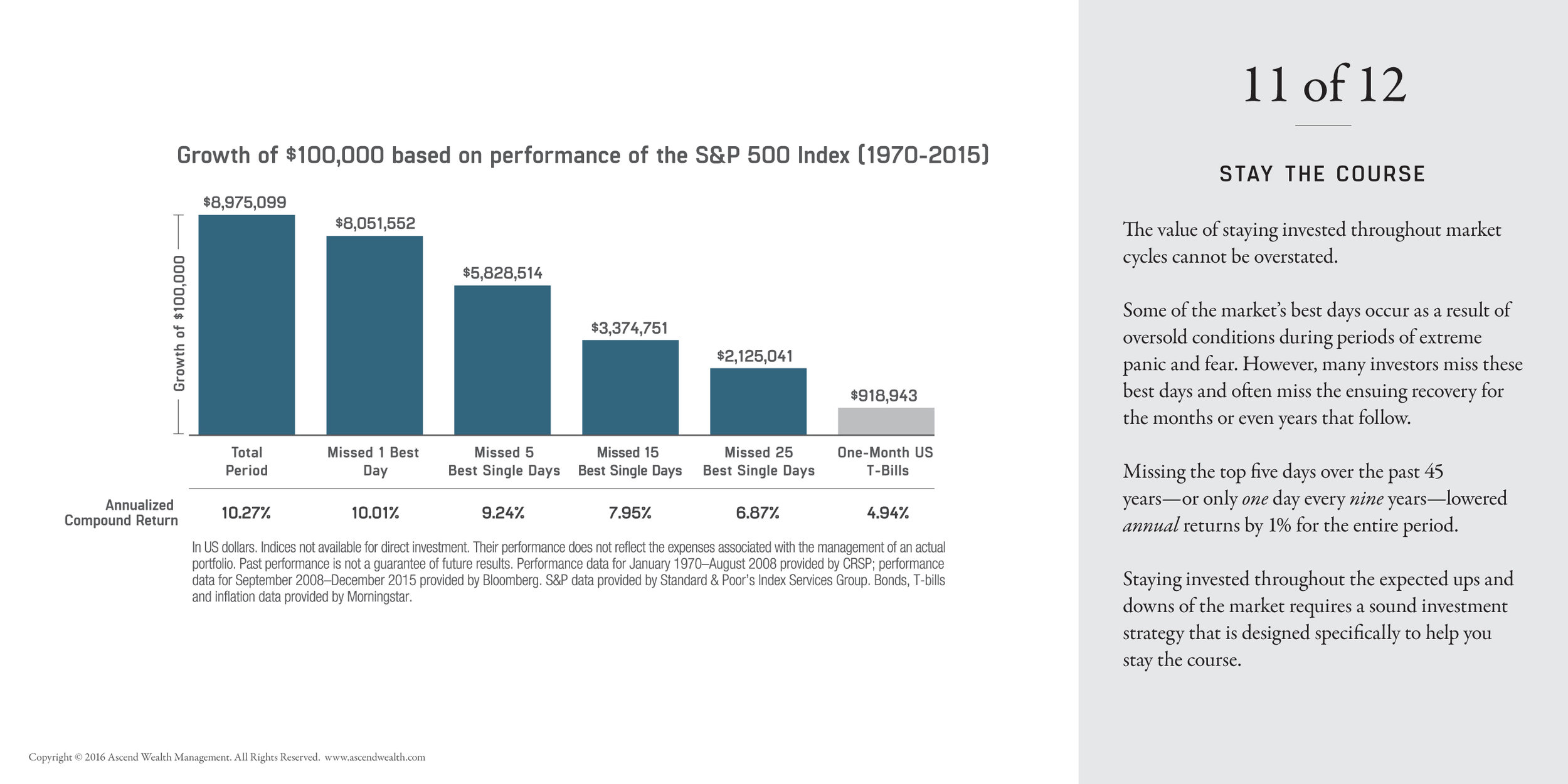

As a research-driven firm, our approach to investing is rooted in decades of academic and empirical evidence. Rather than relying on forecasts and predictions (“speculation”) to manage your wealth, we are keenly focused on the factors proven to deliver investment success—asset allocation, risk mitigation, cost reduction, portfolio structure, diversification, tax efficiency, and rebalancing—regardless of what the future holds. In short, our strategy is designed to be successful over time rather than having a chance of being right for a time.

We do this because it’s what the evidence suggests we should do.